- SCHOOLS

- SCHOOLS

-

STUDENTS

Future StudentsLife at UTHealth HoustonCurrent Students

-

STUDENTS

- Future Students

- Academics

- Admissions

- Degrees Offered

- CARES Act Compliance

- Life at UTHealth Houston

- About Houston

- Mental Health Resources

- Student Governance

- Texas Medical Center

- Current Students

- Calendar

- Campus Maps

- Canvas

-

Student Portal

Connect to the most sought after resources on campus!

-

PATIENTS

713-486-4000713-486-4000

Find A DentistThrough its student, advanced education, and faculty clinics, the School of Dentistry offers a wide range of dental care services to patients of all ages.

713-500-3267713-500-3267

Make An AppointmentUT Health Services is a primary care provider and part of the faculty clinical practice of Cizik School of Nursing at UTHealth Houston.

1-888-4UT-DOCS1-888-4UT-DOCS

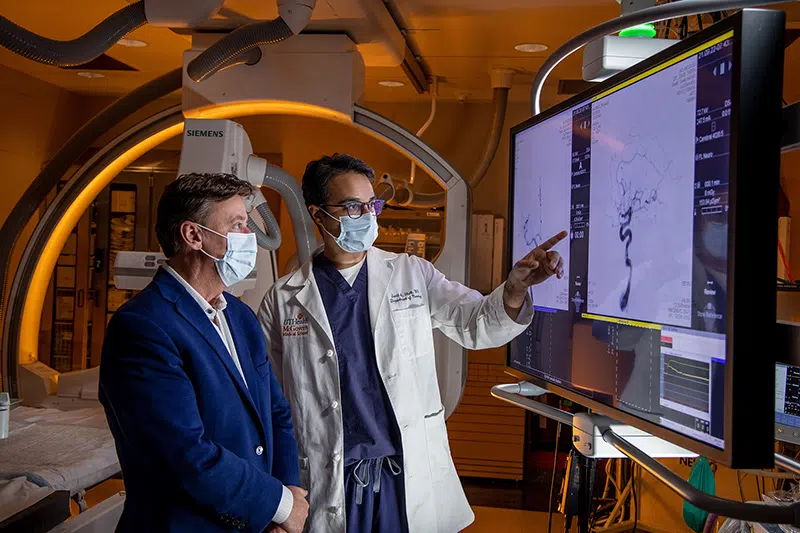

Find Your DoctorWith over 2,000 clinicians certified in more than 80 medical specialties and subspecialties, UT Physicians provides multi-specialty care for the entire family. UT Physicians is the medical group practice of McGovern Medical School at UTHealth Houston.

-

PATIENTS

-

713-486-4000713-486-4000

Find A DentistThrough its student, advanced education, and faculty clinics, the School of Dentistry offers a wide range of dental care services to patients of all ages.

-

713-500-3267713-500-3267

Make An AppointmentUT Health Services is a primary care provider and part of the faculty clinical practice of Cizik School of Nursing at UTHealth Houston.

-

1-888-4UT-DOCS1-888-4UT-DOCS

Find Your DoctorWith over 2,000 clinicians certified in more than 80 medical specialties and subspecialties, UT Physicians provides multi-specialty care for the entire family. UT Physicians is the medical group practice of McGovern Medical School at UTHealth Houston.

-

-

RESEARCH

Research at UTHealth HoustonResearch OfficesOther Research Resources

-

RESEARCH

- Research at UTHealth Houston

- Research News

- Research Centers and Institutes

- Research at the Schools

- Research Offices

- Office of Research Administration

- Sponsored Projects Administration

- Office of Technology Management

- Office of Postdoctoral Affairs

- Clinical Trials Resource Center

- Other Research Resources

- Cores and Shared Research Resources

- Research Training

- Visiting Scholars Program

- Center for Clinical and Translational Sciences

- Institutional Information

-

Clinical Trials

Clinical trials have helped us to discover new treatments that make our lives better. Consider making an impact on health care by participating in a clinical trial.

Learn More

-

GIVE

Philanthropy at UTHealth Houston

Featured Donor

Featured DonorWe are fortunate to count on so many giving-hearted supporters, and we want to share some of their stories with you. We want to show you the courage, the determination, and the generosity of spirit that define their journeys with UTHealth Houston.

-

GIVE

- Philanthropy at UTHealth Houston

- UTHealth Houston Giving

- Give Now

- Ways to Give

- Support Our Schools

- Impact Stories

- Contact the Office of Development

- Alumni Resources

-

Featured Donor

We are fortunate to count on so many giving-hearted supporters, and we want to share some of their stories with you. We want to show you the courage, the determination, and the generosity of spirit that define their journeys with UTHealth Houston.

- About

- Careers

- News

- Events

- A-Z

- Webmail

- Inside the University

-

Search UTHealth Houston